Renters Insurance in and around Mobile

Mobile renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Trying to sift through deductibles and savings options on top of managing your side business, family events and your pickleball league, takes time. But your belongings in your rented apartment may need the remarkable coverage that State Farm provides. So when trouble knocks on your door, your souvenirs, videogame systems and sound equipment have protection.

Mobile renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Protect Your Home Sweet Rental Home

Renters insurance may seem like the last thing on your mind, and you're wondering if having it is actually beneficial. But pause for a minute to think about how much it would cost to replace all the belongings in your rented apartment. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your possessions.

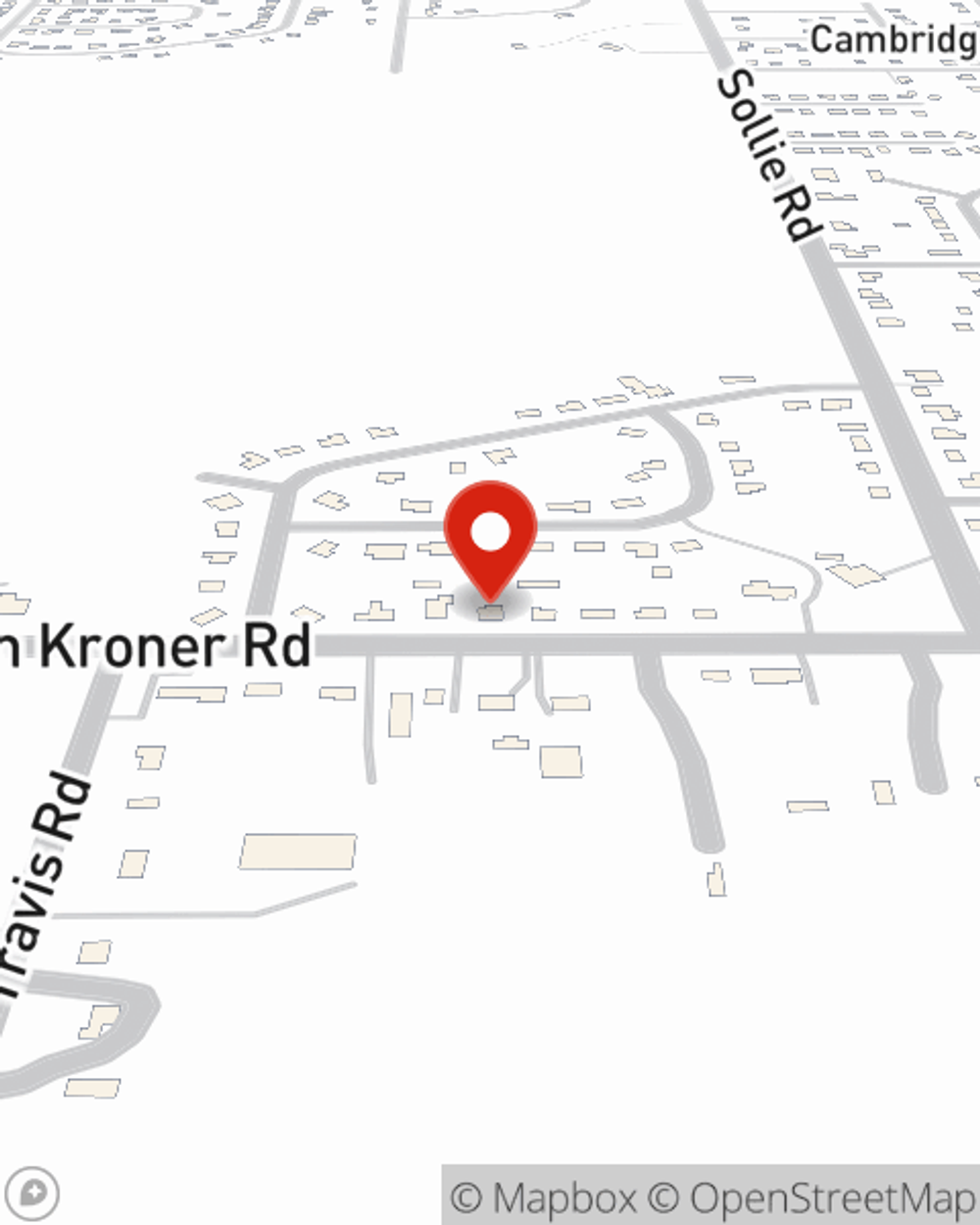

As a trustworthy provider of renters insurance in Mobile, AL, State Farm aims to keep your life on track. Call State Farm agent Otto Brewer today and see how you can save.

Have More Questions About Renters Insurance?

Call Otto at (251) 660-9962 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Otto Brewer

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.